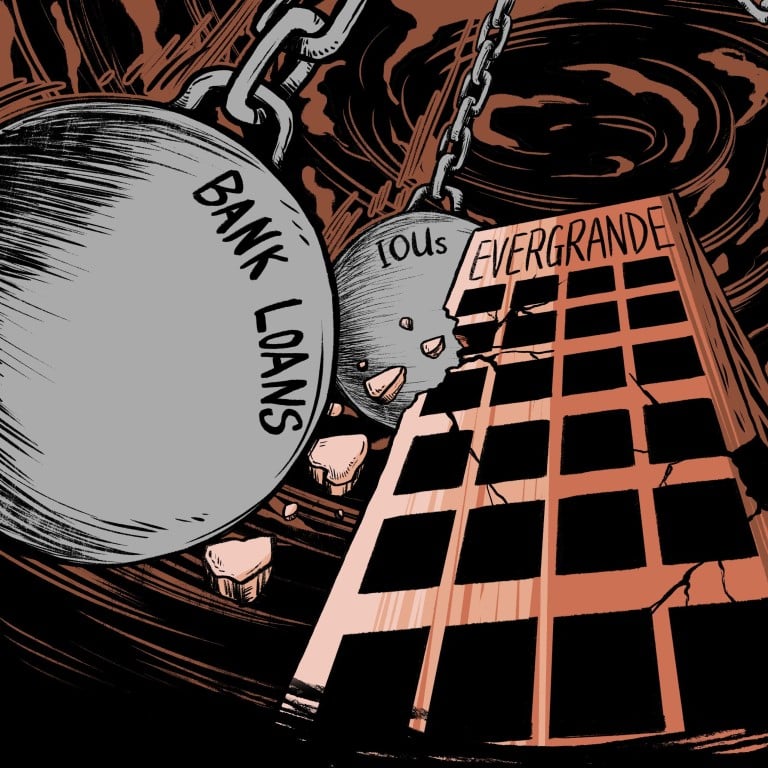

In January 2024, a tremor shook the global financial landscape with the official collapse of China’s Evergrande Group. Once the world’s second-largest real estate developer, the company crumbled under the weight of a staggering $300 billion debt, sending shockwaves through China’s economy and raising concerns about the dangers of excessive leverage in the real estate sector worldwide.

Evergrande’s story is a cautionary tale, highlighting the inherent risks associated with relying heavily on borrowed funds to fuel growth. Its aggressive expansion strategy, fueled by easy credit and an insatiable demand for housing in China, masked financial vulnerabilities that ultimately proved unsustainable. While the immediate consequences are felt most acutely in China, the Evergrande saga offers valuable lessons for the entire world, where real estate markets often dance on the edge of affordability and stability.

A House of Cards Built on Debt:

Evergrande’s ascent was remarkable. Founded in 1996, the company capitalized on China’s rapid urbanization, constructing sprawling residential complexes and luxury apartments across the country. Its growth, however, was primarily driven by debt. The company borrowed heavily, often at high interest rates, to finance its ambitious projects, believing that ever-rising property prices would guarantee returns.

This strategy worked as long as the market boomed. Homebuyers, lured by promises of appreciation and fueled by easy credit, eagerly purchased pre-construction apartments, injecting cash into Evergrande’s coffers before a single brick was laid. This, in turn, allowed the company to borrow even more, creating a dangerous cycle of debt-fueled expansion.

However, cracks began to appear in 2021. China’s government, aiming to curb financial risks, introduced stricter regulations on lending to the real estate sector. This choked off Evergrande’s access to credit, making it increasingly difficult to service its mounting debt. As sales slowed and defaults rose, the house of cards began to crumble.

The Domino Effect:

The consequences of Evergrande’s collapse are far-reaching. Thousands of homebuyers, who invested their life savings in pre-sale apartments, face an uncertain future, fearing they may never see their dream homes materialize. Even if apartments are eventually completed, their value could be significantly lower than initially anticipated due to the negative stigma associated with Evergrande and potential construction quality concerns. Additionally, the company’s vast network of suppliers and contractors are left scrambling, facing unpaid bills and potential financial ruin.

The impact extends beyond Evergrande’s immediate network. The company’s financial woes have triggered a broader slowdown in China’s property market, with ripple effects on related industries like construction, steel, and cement. This, in turn, could dampen economic growth, not just in China but also globally, given China’s significant role in the world economy.

A Global Concern:

While the immediate crisis is centered in China, the underlying issue of excessive leverage in real estate markets resonates globally. In many countries, property prices have soared in recent years, fueled by low interest rates and quantitative easing policies. This has led to concerns about asset bubbles and potential financial instability in the event of a market correction.

The Evergrande saga serves as a stark reminder of the dangers associated with relying heavily on debt to inflate asset prices. It highlights the need for sound financial regulations, prudent lending practices, and diversified economic growth strategies to avoid similar pitfalls in the future.

Lessons Learned:

The collapse of Evergrande offers several key lessons:

-

- The dangers of excessive leverage: Overreliance on debt can create financial vulnerabilities that leave companies exposed to even minor economic shocks.

-

- The importance of prudent regulation: Financial regulations and responsible lending practices are crucial to ensuring market stability and preventing excessive risk-taking.

-

- The need for balanced economic growth: Overdependence on any single sector, like real estate, can leave economies vulnerable to external shocks.

-

- The importance of transparency: Companies must be transparent about their financial situation and risks to avoid eroding investor confidence.

The Evergrande saga may be a Chinese story, but its ramifications are global. By acknowledging the dangers of unchecked leverage and prioritizing sustainable growth, we can all learn from this cautionary tale and build more resilient economies for the future.

At Complete Housing, we never borrow money or charge you any interest. We believe that long-term stability is more important than fast short-term growth. You can rest assured that what happened with Evergrande will not happen to us. You can check out our housing models here, or you can order a custom design. We offer payment plans of up to 5 years in most cases, and we never charge interest.